Overview

BBC3 is a unique and successful channel which has cost in excess of £1 billion to establish. BBC Management has a strategy to close the service and launch a new service online. This paper sets out an alternative vision which will maximise return to the licence payer and save the linear channel.

Key issues

We believe that the closure of BBC3 as a linear channel and its migration to a much reduced version online is a huge mistake both for the BBC and for the licence payer. There is an alternative way.

Avalon and Hat Trick wish to offer to pay the BBC fair value for BBC3. “BBC3” in this context means the ongoing right to broadcast original and acquired programming currently offered under the brand name BBC3. If necessary we would operate the channel under a new brand name.

We have been informed by BBC management that not only is BBC3 not for sale but that there is nothing to sell and that there is no alternative but for it to be closed.

We hope with this paper to persuade the BBC of the value of our proposal and to persuade them to engage openly with a process which would allow us to accurately offer fair value to the ultimate benefit of the licence fee payer. This would require them to cooperate and share relevant management information. To date we have had to proceed without either of these things. Notwithstanding this, we consider that there is enough information in the public arena which allows us to conclude that the channel is viable commercially.

Below we set out why the proposal to move the channel online is flawed, followed by analysis by Xsequor Partners LLP and research company GfK which demonstrates that BBC3 is a valuable asset which could be run commercially.

BBC3 is a valuable asset that should be saved

The key points:

1. BBC3’s asset value. In order to assess fair value to make a complete bid we would need access to management information but on the best evidence currently available we propose a value in the region of £100 million. Ongoing payments will be made for licensing BBC programmes.

2. BBC3 is unique and highly successful in offering new and innovative programming for an underserved young audience (16-34 year olds). This is significant not only in promoting inclusiveness as a social good but it also builds loyalty and an audience for the future.

3. It is acknowledged worldwide that TV channels are the most economical way to launch new content and reach the widest possible audience. It is notable that leading online entities (for example Vice and SBTV) are seeking traditional TV channels as part of their strategy for growth. Moving BBC3 in the opposite direction flies in the face of industry opinion and practice.

4. Once linear BBC3 is closed, its presence on terrestrial, cable and satellite television will be impossible to resurrect. In the current financial climate no broadcaster could afford to invest £1 billion to launch and develop a new linear channel. A resource that has taken an enormous amount of money and effort to develop is being shut with no attempt to extract value from it.

5. The BBC management plan has been proposed as a cost saving measure but it involves the launch of a new service online which has inevitable substantial associated costs. These have not been disclosed therefore the true extent of the savings is unclear. Already a new controller has been hired and costs have begun to be incurred.

6. As a practical matter digital delivery requires high speed broadband facilities which are not universally available across the country. BBC3 online will therefore inevitably become less available to large parts of its target demographic.

7. New digital ventures are notoriously risky. Indeed the BBC’s own recent Digital Media Initiative was closed by Tony Hall having lost £100 million.

8. The BBC’s own research shows that 86% of respondents did not want BBC3 closed.

The BBC Management itself stated when announcing the closure of the linear channel that this was the “least worst alternative” given the current difficult financial position it finds itself in. We submit that this is wrong and contend that the licence fee payer is entitled to a fair return on the more than £1 billion already invested. We will pay a minimum of £100 million to the BBC for the channel. In addition, our analysis shows that the spend on original UK content can be increased by between £20 million and £40 million per annum to the advantage of both suppliers and viewers. Our alternative is a way for the BBC to realise value which will otherwise be lost.

BBC3’s viability as a commercial venture

As we have not had access to management data we have commissioned a report prepared by Xsequor and the research company GfK who have used publicly available information, BARB data and industry estimates. GfK is a well respected company in the industry whose clients include the BBC, Sky and Channel 4. The report shows that:

• BBC3 leads audiences in the commercially valuable 16-34 age group.

• BBC3 has a valuable male bias.

• BBC3 could generate in excess of £170m per annum at 2015 prices.

• BBC3 could afford to increase content budgets by 25-50% year on year.

• BBC3 under new ownership can recalibrate its cost base, increase innovation and improve the diversity of its overall talent base.

• BBC3 would deliver commercial audiences that are valuable and differentiated.

• BBC3 could pathfind a new financial model with external funding sources.

See the appendix for the detailed commercial analysis of BBC3.

Additional considerations – Traditional platform vs Online

We believe TV channels deliver an experience that an online collection of videos cannot. The evidence suggests that talent and shows are created on TV. They may be supported subsequently by online delivery but the driver and the primary means by which viewers engage with high quality original content is via TV channels. TV channels deliver a curated experience that sits apart from a warehouse of content that the viewer has to select when s/he is using a digital platform. Viewers appreciate channels in a specific and special way. The BBC’s own research suggests that viewers have brand loyalty toward specific channels as well as individual programmes.

The BBC’s own research also shows that BBC3 meets a need with its viewers. Viewers feel passionately about the prospect of losing it. It delivers a key part of the overall BBC remit and one that cannot quickly be replaced, if at all. The BBC research goes further and suggests only 14% of respondents thought closing BBC3 as a channel was a good idea. In other words, 86% did not.

We believe broadcasting channels once established are here to stay and should not be seen as interchangeable with online or other delivery methods.

We also believe that BBC3 benefits the wider broadcasting community. These benefits will be lost if BBC3 is moved online. Specifically BBC3 nurtures talent that can be further developed on other channels both in front of and behind the camera and crucially, it retains difficult to reach 16-34 year old adults. This reach entices younger viewers into viewing television content. Further, we are concerned that reducing the spend and ease of access on content for 16-34 year old viewers will have a negative effect in the future. Potentially this decision could create a generation that disconnects from traditional television and the wider broadcasting community. This effect will compound as they age. Disinvesting and disconnecting from viewers that value the channel is unlikely to increase their engagement with wider television output and plays into the hands of new and existing competitors. It gifts them audiences that feel their interests are ignored. This view is supported by the BBC’s own research.

The BBC has already flagged that the landscape is changing and new, inventive and bold competitors are now seeking to entice audiences to their offerings. We believe that a non-competitive, online strategy will fail to deliver for audiences both in the short and long term.

We don’t believe the spend and access for young viewers should be diminished. If anything it should be increased. A strategy which replaces BBC3 output with increased spend on drama on BBC1 and BBC2 as well as the proposed plus one channel lacks focus and purpose and is confused. If town planners shut down Top Shop on the High Street but said M&S was expanding so “you can get more stuff where your Mum shops” we know that the effect would be, a gaping hole in the High Street for young shoppers.

The licence payer via the BBC has sunk c. £1bn into BBC3 over the last 10 years and we know that the cost of recreating BBC3 from scratch would still be many hundreds of millions of pounds. It seems perverse that in order to save £30m the channel could be closed. Whilst it is appreciated that choices need to be made in straitened times cuts should be made to overhead rather than to successful content, the broadcasting of which is a core purpose of the BBC.

BBC3 online would become one more website in a content landscape with low barriers to entry, low content spends, low differentiation and low engagement. In effect it would virtually disappear. A content location online does not attract talent in its own right but survives by buying in content that has been established on TV channels. The BBC and BBC3 do not need to walk backwards into a space where its assets and capabilities count for little.

New entrants such as Netflix and Amazon have budgets for single series which exceed the total spend proposed for BBC3 online. It is naïve to think that BBC3 online can compete effectively in those circumstances.

Precedent and practicality for BBC selling assets including channels

The BBC has precedent for selling channels: recently 49.9% of BBC America was sold to US operator AMC and 50% of the BBC operation UKTV is owned by US operator Scripps. The BBC has sold many other assets in the past including buildings, production facilities and magazines. There does not seem to be a barrier to asset disposal when there is a will. Indeed the current BBC management’s proposals to the Trust include the sale of BBC generated and owned productions to other third party commercial channels

There are a number of areas that need to be addressed to enable the sale. The biggest appears to be that of split rights, however this can be overcome as all the rights holders, including the BBC, will benefit financially. Assuming the BBC Management engages in a collaborative process other issues of cross promotion, spectrum, brand and content deals can easily be resolved. The wider industry and specifically other suppliers wish the channel to continue.

Conclusion

BBC3 is a thriving channel which should not be closed. It is unprecedented for the BBC to close a successful service. BBC current strategy will not realise value for the licence payer and there are better alternatives not least a commercial future for the channel.

APPENDIX

BBC3 – A Commercial Analysis

We have looked at BBC3’s current placement within the broadcast landscape and its commercial viability. This analysis has assumed that transmission hours, output, cross promotion and all other parts of the output remain constant.

It is clear that within its transmission hours of 1900-2800 BBC3 excels and there is no reason why that success could not be replicated in other parts of the day.

Additionally BBC3 could sustain its own online presence that could deliver further commercial return although that has not been part of the high-level revenue assessment

Table 1

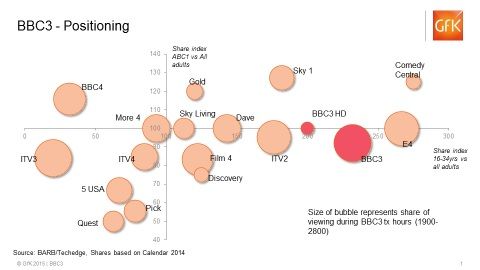

This chart shows a peer group relative performance against 16-34 adults and gender bias.

The 16-34 age group is highly valuable commercially and is one of the more challenging to deliver. Within that group, young men are even more difficult to reach.

Key points

1. BBC3 has a clearly differentiated 16-34 delivery beating many commercially successful channels.

2. BBC3 within 16-34’s, has a valuable male bias.

3. BBC3 has scale in delivery which can be considered as a proxy for delivering unique reach or light viewers who have even greater commercial value.

Table 2

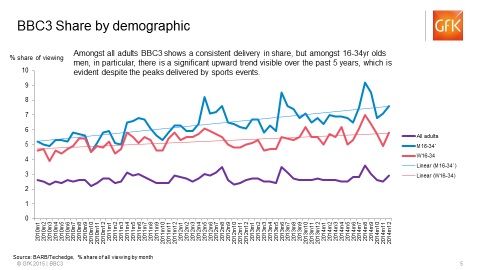

This chart shows how strongly BBC3 performs in delivering a young and upmarket audience compared to its competition.

Key points

1. This chart shows the scale of delivery of a young and relatively upmarket audience matched only by E4.

2. Scale and profile in hard-to-reach and valuable demographics is a key market differentiator and would enable the channel potentially to command higher prices.

3. Young, wealthy, brand conscious consumers who have not yet settled into narrow brand repertoires and have high switching and sample rates are amongst the most valuable; if you switch them young and hold onto them they will grow older with you.

Table 3

This chart shows the strong BBC3 total audience share performance over time.

Key Points

1. BBC3 has managed to maintain its all adult share despite a fragmenting broadcast landscape.

2. BBC3 has managed consistently to increase its 16-34 share performance over time.

3. BBC3 performs most strongly in 16-34 male audiences increasing its share at an even greater rate.

Table 4

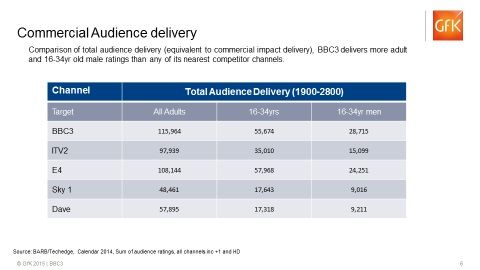

Analysis of ratings and share performance reveal key points of the output that we believe would drive commercial return.

Most of what follows would be seen as highly desirable by BBC3’s competitors and they would welcome its removal from the landscape.

We have compared BBC3 to a peer group of the most successful channels outside of the main PSBs so we exclude BBC1, BBC2, ITV1, C4 and Five.

Unless stated, our analysis is drawn from 2014 calendar 16-34 Adult performance. Comparisons are made across BBC3 transmission hours on the basis that if the channel performs well against others when it is transmitting, there is no reason why it would not do well if it expanded its hours.

Where possible comparisons have been made against those commercial channels that are known to be ad-funded and successful.

The following conclusions can be drawn:

1. BBC3 is the most watched channel across all platforms taken together.

2. BBC3 is growing.

3. BBC3 is the most watched channel on DTT.

4. BBC3 delivers a 14% greater audience than E4, but does so with a 112 index to men as opposed to E4’s 109 index to females.

5. BBC3 delivers 48% of its volume of audience in the top five of its shows. E4 delivers 68%, Dave 57% and Sky 1 47%. BBC3 has a broader spread of delivery and less of its eggs in one basket, indicating a greater opportunity to deliver reach.

6. BBC3 beats Sky 1 on DSAT.

7. BBC3 delivers a 16-24 audience 25% higher than E4.

8. BBC3 delivers a 16-24 audience 400% larger than Sky 1.

9. 40% of shows on BBC3 have an audience greater than 115,000 beating other peer channels.

Revenue Potential

Detailed revenues for competing channels are notoriously difficult to pin down. They are not released in company reports and they are not, directly, used to trade and price set. Having said that there are estimates of revenue for channels or channel groups and analysing these estimates has enabled us to derive a likely revenue performance for the relevant channels.

The revenue estimates assume reasonably constant audience shares as compared to 2014 and commercial impact delivery that reflects average minutage movement of other channels i.e. it assumes flat minutage per hour and that any movement into higher rating hours is a constant for all channels.

At this stage sponsorship or product placement revenues have not been included but they may increase spot revenues by as much as 5-10%.

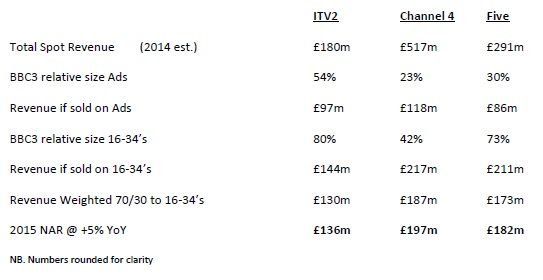

Methodology

In order to derive a spot revenue range comparisons have been made between BBC3’s size as against the size of a known rival channel’s audience and then that factor applied to the estimate of that channel’s revenues. For example, if a channel took £150m and BBC3 was half its size it is assumed BBC3 could take half the revenue i.e. £75m.

In the above calculations we have assessed the audience comparison against adults and also 16-34 age adults. Significantly more airtime is traded on adults but there exists in the market enough demand to enable BBC3 to up weight on 16-34 advertisers. We have assumed that 70% of the revenue would be derived from 16-34 campaigns with the balance being campaigns targeted at adults more generally.

Given the number of variables that exists in actually contracting airtime revenues these are very much estimates, however it is not optimistic to include these as a potential source of further revenue.

We have taken all time shares as if the channel was placed onto the market today with the transmission hours it currently has even though other channels may have greater on-air time. It is known that BBC3 is the highest rating channel in its transmission hours and therefore these estimates should be seen as a floor (rather than a ceiling) because the potential exists to increase transmission hours.

This analysis assumes that BBC3 could be sold equally as well as any of the channels it is compared with. We know that CRR forbids ITV conditionally selling ITV2, and that this can be seen as a standalone performance, and that C4 is also sold as a standalone channel without other leverage or bundling. We believe Five, for the purposes of this comparison, existed as a standalone TV sell with limited (if any) cross sell to the Viacom or Northern and Shell print assets.

Table 5

Taking ITV2 and Five as examples the 16-34 audience size is within a range that should enable the same pricing dynamics to prevail.

The above would give an average comparative revenue take for 2015 of approximately £172m.

The above revenue makeup obviously ignores other profitable demographics such as 16-24’s, 16-34 men and those advertisers specifically demanding light viewing audiences.

Assumptions have been made about sales costs and sales representations but a number of options are open either by joining a sales house or by bulk selling the entire output to be brokered on. At this stage it is too early to settle upon the optimum solution.

One thing is abundantly clear and that is the high value of an audience of this scale and profile.

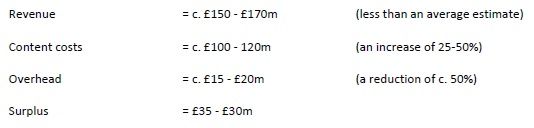

High level P&L components

About GfK

All ratings analysis has been sourced from BARB data and analysed by GfK, a leading market research company and trusted source of relevant market and consumer information

For more information, please visit www.gfk.com

For further information contact: Dan Lloyd at Avalon on 020 7598 7222 / danl@avalonuk.com